rhode island tax table 2021

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax 5.

. Every state with an income tax as well as the IRS support the Single filing status. Any income over 150550 would be taxes at the highest rate of 599. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have.

How Income Taxes Are Calculated. Personal Income Tax Tables 2021 Personal Income Tax Tables PDF file less than 1 mb megabytes. Rhode Island Income Tax Rate 2022 - 2023.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. The full list of rates can be found in the table below. WHEN AND WHERE TO FILE The due date is April 15 2022 for returns filed for the calendar year 2021 and the 15th day of the fourth month following the close of the taxable year for returns filed for a year ending other than December 31.

This form is for income earned in tax year 2021 with tax returns due in April 2022. To calculate income tax for grantor. The table below provides the aggregate figures for the information provided pursuant to RI.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. More about the Rhode Island Tax Tables We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. The state income tax table can be found inside the Rhode Island 1040 instructions booklet.

Please use the link below to download 2021-rhode-island-tax-tablespdf and you can print it directly from your computer. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax. Ad Compare Your 2022 Tax Bracket vs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Rhode Island 1040 instructions and the most commonly filed individual income tax forms are listed below on this page. Rhode Islands income tax brackets were last changed one year prior to.

You can quickly estimate your Rhode Island State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross. DO NOT use to figure your Rhode Island tax. Overall Rhode Island Tax Picture.

The Rhode Island Department of Revenue is responsible. Rhode Island Cigarette Tax. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. RI Schedule CR 2021.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. The table below shows the income tax rates in Rhode Island for all filing statuses. Over But not over Pay percent on excess of the amount over 0 2650 375 0 2650 8450 9938 475 2650 8450 -- 37488 599 8450 Table is for non-grantor trusts and non-bankruptcy estates.

Rhode Island Single Tax Brackets TY 2021 - 2022 What is the Single Income Tax Filing Type. Ed Rhode Island return. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Provisional 2022 tax rates are based on Rhode Islands 2021. Income tax rate schedule for tax year 2021 trusts and estates Taxable income. The federal gift tax has an exemption of 15000 per person per year in 2021 and 16000 in 2022.

Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550. TAX 2650 13128 2650 Over But not over 2650 8450 Over 8450 375 475 599 These schedules are to be used by calendar year 2021 taxpayers or fiscal year taxpayers that have a year beginning in 2021. Your 2021 Tax Bracket To See Whats Been Adjusted.

Find your pretax deductions including 401K flexible account contributions. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. Find your gross income 4.

Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Laws 42-6420-9a 1 for the Rebuild Rhode Island Tax Credit program for the fiscal year of July 1 2020 through June 30 2021. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have.

The Rhode Island State Tax Calculator RIS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Start by finding your taxable estate bracket. Income Tax Brackets.

Tax Rate Starting Price Price Increment Rhode Island Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 007 120 008 140 010 160 011. The state has a progressive income tax. Single is the filing type used by all individual taxpayers who are not legally married and who have no dependants for whom they are monetarily responsible.

Find your income exemptions 2. Rebuild Rhode Island Tax Credit For the Fiscal Year Ending June 30 2021 Number of Applicants Receiving Rebuild RI. The Rhode Island tax rate is unchanged from last year however the.

RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes. Discover Helpful Information And Resources On Taxes From AARP. Mail your return to.

Rhode Islands tax on cigarettes is the. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table 1. Rhode Island Division of Taxation One Capitol Hill.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect your applicable local sales tax rate.

The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. RI-1040MU 2021 Credit for Taxes Paid to Other State multiple.

Rhode Island income taxes are in line with the national average. To estimate your tax return for 202223 please select the 2022 tax year. RI-1041 TAX COMPUTATION WORKSHEET 2021 BANKRUPTCY ESTATES use this schedule If Taxable Income- RI-1041 line 7 is.

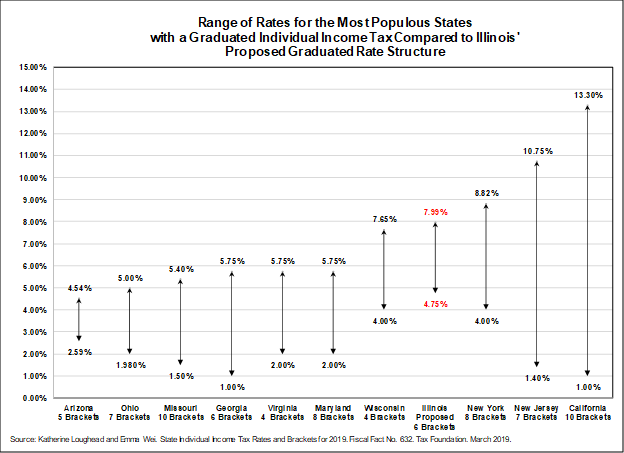

Individual Income Tax Structures In Selected States The Civic Federation

Individual Income Tax Structures In Selected States The Civic Federation

Office Of Employee Benefits Rhode Island Office Of Employee Benefits

Taxation Of Social Security Benefits Mn House Research

Rhode Island Paycheck Calculator Smartasset

New Mexico Tax Forms And Instructions For 2021 Form Pit 1

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation