net operating working capital definition

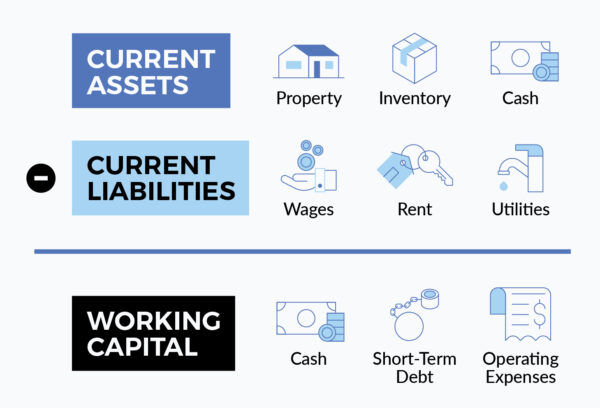

Working Capital and Operating Working Capital. Operating working capital is defined as operating current assets less operating current liabilities.

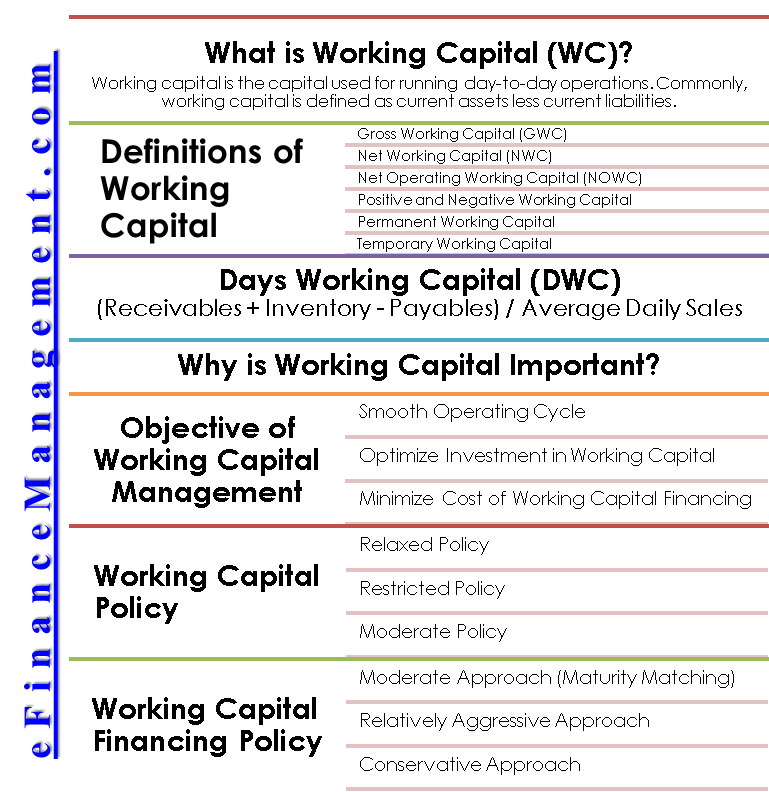

Working Capital Define Importance Objective Policy Manage Finance

This liquidity ratio demonstrates how able a company is to pay off its current operational liabilities with its current operational assets.

. Check here the definition of net working capital with formula and example. It is a measurement of a companys liquidity and looks like this. A net working capital formula is an equation that measures a companys ability to pay off current liabilities with assets.

Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Net Working Capital NWC is the difference between a companys current assets and current liabilities. Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating liabilities.

And How To Calculate It Why is net working capital important. Gross working capital is equal to current assets. Net working capital is calculated by subtracting a businesss current liabilities from its current assets.

In the second step using equations 3 and 10 we calculate the values for the net operating working capital as defined in the statement of cash flow DELTA NOWCsubSCF and in the expression for the free cash flow measure DELTA NOWCsubFCF for the years 2012 to 2014. BBY using the following balance sheets. Net Working Capital NWC Operating Current Assets Operating Current Liabilities The reason is that cash and debt are both non-operational and do not directly generate revenue.

Working capital is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities. Define Minimum Net Operating Working Capital. Toll Free 1800 309 8859.

They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due. Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating. It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in.

In fact cash and cash equivalents are more related to investing activities because the company could benefit from interest income while debt and debt-like instruments would fall into the financing activities. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. Operating working capital OWC is defined as operating current assets less operating current liabilities.

Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Businesses use net working capital to measure cash flow and the. What Is the Operating Expense Formula.

Means as of the end of any of the Companys fiscal quarters and excluding the effect of discontinued operations the total of current assets minus current liabilities minus cash and equivalents plus current maturities of long- term debt including revolver balances included in current liabilities plus net property plant and equipment PP. Net working capital is calculated by subtracting a businesss current liabilities from its current assets. It is similar to the basic concept of working capital in that it is calculated by subtracting a companys liabilities from its assets but it more narrowly defines what constitutes those assets and liabilities.

Working capital is generally defined as current assets minus current liabilities although it is a bit more complicated when you drill down on the specifics. Current assets include cash accounts receivable and inventories and exclude marketable securities. Net operating working capital NOWC is the excess of operating current assets over operating current liabilities.

Current assets - current liabilities net working capital. Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses. A buyer which may be a private equity or strategic acquirer generally addresses net working capital at the onset of a potential transaction.

Net working capital is the aggregate amount of all current assets and current liabilities. Net Operating Working Capital Operating Current Assets Operating Current Liabilities Example Calculate total net operating capital for Best Buy Inc. --The incremental net operating working capital intensities are 262 236 and 307 in.

Shall be determined by the Closing Date Balance Sheet and shall mean the Companys current assets including Minimum Cash cash and cash equivalents accounts receivables and prepaid expenses but excluding deferred tax assets minus the Companys current liabilities including accounts payable and accrued expenses. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. Operating working capital OWC is a financial metric designed to accurately determine a companys liquidity and solvency.

Define Net Operating Investment. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses. Working capital is calculated as current assets minus current.

Operating current assets are assets that are a needed to support the business operations and b expected to be. The term operating identifies assets or liabilities that are used in the day-to-day operations of the business or that are not interest-earning or bearing financial. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial.

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Ratio Analysis Example Of Working Capital Ratio

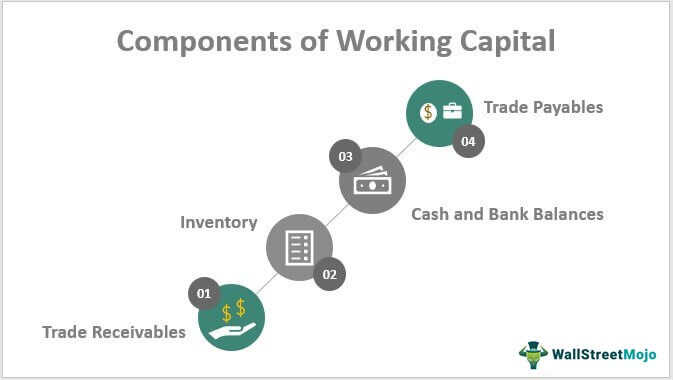

Components Of Working Capital Top 4 Detailed Explained

Net Working Capital Formula Calculator Excel Template

Working Capital Cycle Efinancemanagement

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital What It Is And How To Calculate It Efficy

Working Capital Requirement Bba Mantra

How To Calculate Working Capital Turnover Ratio Flow Capital

Changes In Net Working Capital All You Need To Know

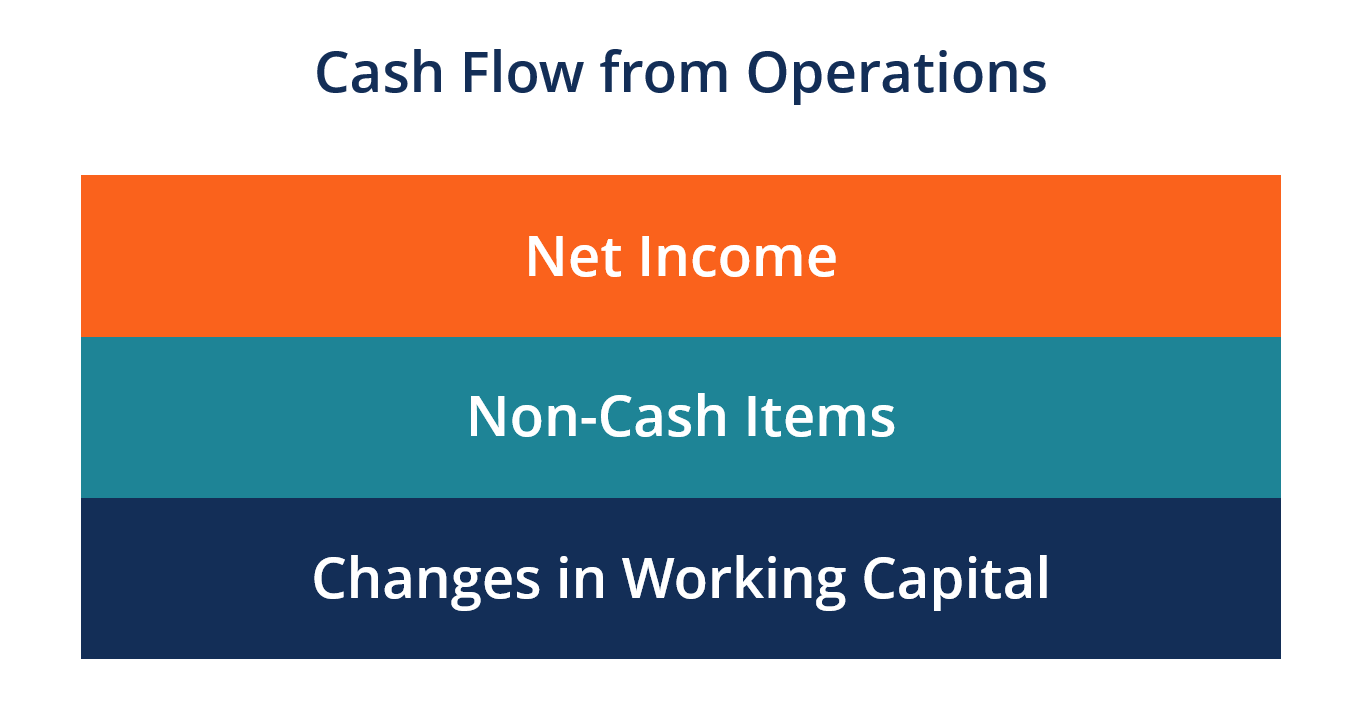

Cash Flow From Operations Definition Formula And Example

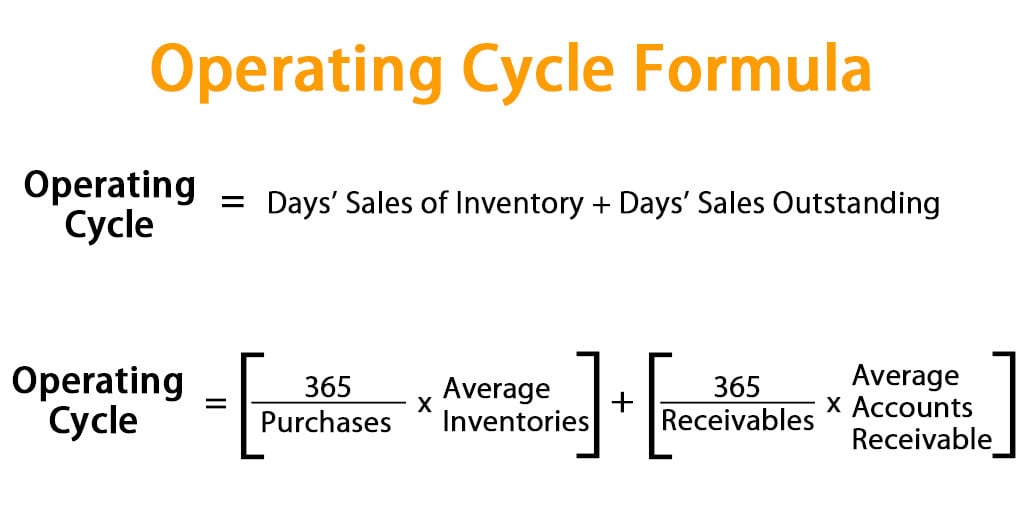

Operating Cycle Formula Calculator Excel Template

Working Capital What Is It And Why Do You Need It Business 2 Community

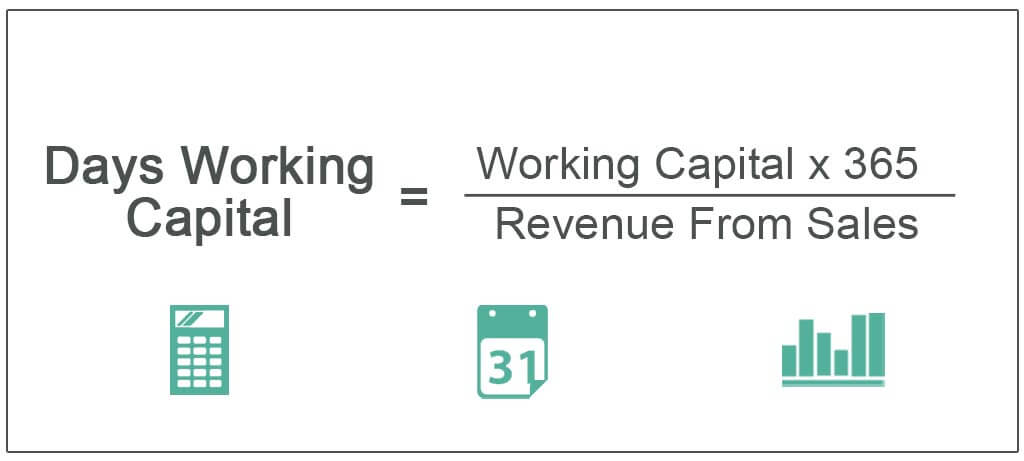

Days Working Capital Definition Formula How To Calculate

Types Of Working Capital Gross Net Temporary Permanent Efm

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)